July 24, 2022

Food For Thought[1]

Rate Shocks – Life Insurer Investment Portfolios

Background – As a follow-up to today’s Commissioner and Chief Financial Regulator Panel[2] discussion on the impact of an interest rate shock on life insurance company investment portfolios, we offer the following thoughts for your consideration:

Simplifying Assumptions - In order to get a high-level sense for a 100 bp upward rate shock in the near future, we used the FYE 2021 NAIC stats for the life industry as a starting point and used our best efforts to estimate the impact of the aforementioned rate hike on insurer investment portfolios. We understand that this is a simplifying assumption because more astute insurers may have altered their investments portfolio asset class mix to better brace for the impact of a rate shock in 2022. That being said, we are of the opinion that it is useful for regulators to estimate the impact of such a rate shock and use it as a basis of comparison for the actual amount of rate impact observed during financial examinations conducted this year.

How did we estimate the impact of a 100 bp rate shock?

We began by reviewing the asset allocation to Bonds held by Life Insurers as of 12/31/2021.

Source: NAIC

In other words, for every $94 billion in investments held by life insurers, about $66 billion was held in Bonds, which is the asset class most impacted by interest rate changes. That being said, our analysis was affected by the fact that the bulk of the impact of rate changes would be felt by Fixed Rate Bonds (as opposed to Floating Rate Bonds). In order to compensate for this issue, we attempted to isolate the amount of the $66 billion in Bonds that would be most impacted, as shown in the table below:

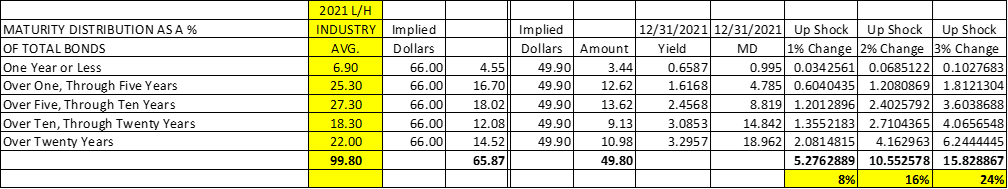

The table above implies that of the $66 billion in Bonds mentioned above, about $49.9 billion (~say $50 billion) would bear the brunt of a rate hike, because most structured securities shown in the table above are Floating Rate Bonds and their coupons would simply adjust upward to reflect the increase in rates. In order to estimate the impact of a rate hike on the $50 billion, we reviewed the industry yield curve as of 12/31/21 for BBB risk (which in our historical experience is a good proxy for insurer Bond portfolios). The table below is an attempt to quantify the impact of a 1% to 3% rate shock on the aforementioned $50 billion.

Source: NAIC data overlaid against Bloomberg Yield Curve for BBB risk.

[1] Food For Thought is a periodic publication of JP CONSULTING tailored to address specific issues of interest in the insurance and banking industries. The opinions expressed in this publication are those of its authors alone – Joseph Prakash, CFA and other LLC Members of JP CONSULTING. If you wish to have your name removed from the distribution list, please respond to our e-mail with the word “Unsubscribe” on the subject line of the e-mail.

[2] SOFE CDS – Session A2 – Commissioner and Chief Financial Regulator Panel on Sunday, July 24, 2022.

As can be seen from the table above, a 1% upward rate shock on $50 billion, would result in an 8% decline in the value of the Bond portfolio. However, for a more severe 3% rate shock, the impact on Bonds would be much larger.